Keurig Dr Pepper reports full year 2021 results and delivery of three-year merger commitments

Keurig Dr Pepper Inc. today reported strong financial results for the fourth quarter and full year ended December 31, 2021 and affirms guidance for 2022.

Full-year 2021 highlights

Strong performance in 2021 marked the successful completion of the Company's three-year merger period, with results that met or exceeded all key commitments. Highlights of 2021 performance include:

- Posted high single-digit net sales growth and double-digit Adjusted diluted EPS growth.

- Grew market share2 in nearly 75% of the Company's cold beverage retail base.

- Added nearly three million new U.S. households to the Keurig system, bringing total Keurig households to almost 36 million, reflecting successful brewer innovation including the Keurig Supreme Plus Smart – KDP's first connected brewer launch.

- Improved KDP's management leverage ratio to 2.9x at year-end 2021.

- Continued to navigate the evolving macro challenges presented by COVID-19 and prioritize and invest in the health and safety of employees.

- Advanced KDP's corporate responsibility agenda, including adding new goals for Diversity & Inclusion, Positive Hydration, and Regenerative Agriculture.

Commenting on the announcement, Chairman and CEO Bob Gamgort stated, "We finished 2021 with exceptional top-line momentum, driven by robust consumer demand across our portfolio, and our third consecutive year of double-digit Adjusted EPS growth. Despite ongoing macro and COVID-related challenges, we successfully delivered our merger commitments on or ahead of the targets we set four years ago. We head into 2022 with confidence in the stronger, faster-growing business we have built, poised to continue to drive outsized long-term value creation in an environment that we expect to remain challenging for some time."

2021 full-year consolidated results

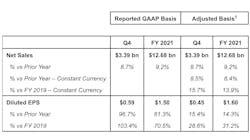

Net sales for the full year of 2021 increased 9.2% to $12.68 billion, compared to $11.62 billion in the year-ago period, driven by strong growth in each business segment. On a constant currency basis, net sales increased 8.4%, driven by higher volume/mix of 5.7% and favorable net price realization of 2.7%. On a two-year basis, constant currency net sales advanced 13.9% versus 2019.

KDP in-market performance in the Liquid Refreshment Beverages (LRB) category remained strong for the year, with retail dollar consumption2 advancing 8.4% versus prior year across the Company's cold beverage retail base, largely reflecting strength in CSDs3, premium unflavored water, coconut water, apple juice, and apple sauce. This performance reflected the strength of Dr Pepper, Canada Dry, A&W, Sunkist and Squirt CSDs, CORE Hydration and Evian premium water, Vita Coco coconut water, Polar seltzers, and Mott's apple juice and apple sauce. On a two-year basis, KDP gained market share in 77% of its cold beverage retail base and grew consumption of its cold beverage portfolio by 22%. KDP's performance in CSDs has been particularly strong, with the Company now holding a CSD share position of nearly 25%.

In coffee, retail dollar consumption of single-serve pods manufactured by KDP in IRi tracked channels grew 2.7% versus prior year and KDP manufactured share remained strong, advancing to 83.2% for the year. Performance in the away-from-home business improved versus year-ago, although the increase in overall consumer mobility has not yet fully translated into a broad return to offices. On a two-year basis, retail consumption of single-serve pods manufactured by KDP increased 12.7% in IRi tracked channels.

GAAP operating income for the full year of 2021 increased 16.7% to $2.89 billion, compared to $2.48 billion in the year-ago period, driven by the strong net sales growth, productivity, merger synergies and the net year-over-year benefit of $28 million from the Company's strategic asset investment program initiated in 2019. This program creates value from certain assets to enable reinvestment in strategic assets. Also contributing to growth was the favorable year-over-year impact of items affecting comparability, including lower COVID-related costs and comparison to a non-cash impairment charge in the year-ago period. Partially offsetting these positive drivers were the impacts of broad-based inflation and significant supply chain disruption across manufacturing, logistics, material inputs and labor availability, all exacerbated by Omicron late in the year. Also impacting the comparison was a double-digit increase in marketing investment, which more than offset the aforementioned $28 million strategic asset investment program benefit.

Adjusted operating income for the full year of 2021 increased 7.2% to $3.42 billion, compared to $3.19 billion in the year-ago period and, on a constant currency basis, Adjusted operating income grew 6.5%. Adjusted operating margin was 27.0% in 2021, compared to 27.5% in the prior year. On a two-year basis, Adjusted operating income advanced 18.3% versus 2019.

GAAP net income for the full year of 2021 advanced 62% to $2.15 billion, or $1.50 per diluted share, compared to $1.33 billion, or $0.93 per diluted share, in the year-ago period. This performance was driven by the growth in operating income, lower interest expense and a lower effective tax rate, as well as the favorable year-over-year impact of items affecting comparability, including an after-tax gain of $400 million on the sale of the Company's equity interest in BodyArmor.

Adjusted net income for the full year of 2021 increased 14.7% to $2.28 billion, compared to $1.99 billion in the prior year. Adjusted diluted EPS for the year increased 14.3% to $1.60, compared to $1.40 in the prior year. On a two-year basis, Adjusted diluted EPS advanced 31.2% versus 2019.

KDP generated exceptionally strong free cash flow totaling $2.57 billion in 2021, primarily reflecting growth in earnings and ongoing effective working capital management. The free cash flow performance, combined with pre-tax cash proceeds of $576 million from the sale of the Company's equity interest in BodyArmor, enabled KDP to reduce total financial obligations by $1.73 billion in 2021 and end the year with $567 million of unrestricted cash on hand. In addition, the Company's management leverage ratio declined to 2.9x at the end of 2021, compared to 3.6x at the end of 2020. Since the close of the merger in July 2018, KDP's management leverage ratio declined by 3.1x.

1 Adjusted financial metrics used in this release are non-GAAP. See reconciliations of GAAP results to Adjusted results in the accompanying tables.

2 Market share and retail consumption data based on Keurig Dr Pepper's custom IRi category definitions for the 13-week and 52-week periods ending 12/26/2021.

3 CSDs refer to "Carbonated Soft Drinks".

2021 full-year segment results

Coffee systems

Net sales for the full year of 2021 increased 6.4% to $4.72 billion, compared to $4.43 billion in the year-ago period. On a constant currency basis, net sales advanced 5.6%, driven by higher volume/mix of 6.5% and lower net price realization of 0.9%. The net price realization reflected continued moderation in strategic pod pricing and customer fines stemming from challenged service levels in the fourth quarter of 2021, only partially offset by the benefit of list price increases on owned and licensed pods and brewers which were implemented late in the year.

The volume/mix growth of 6.5% reflected pod volume growth of 5.6% and exceptionally strong brewer volume growth of 10% that successfully lapped the 21% growth in brewer volume in the prior year. The pod volume performance reflected continued strong growth in the at-home business, largely reflecting the benefit of significant growth in households in the Keurig system, and improving trends in the away-from-home business. The strong brewer growth was driven by continued, successful innovation, marketing investment to grow household penetration and a strong holiday season. For the full year, U.S. households regularly using a Keurig brewer increased approximately 9% on top of similar growth in 2020.

GAAP operating income increased 3.9% to $1.32 billion in 2021, compared to $1.27 billion in the year-ago period. This performance reflected the growth in net sales, productivity and merger synergies, as well as the favorable year-over-year impact of items affecting comparability. Partially offsetting these drivers were the impacts of broad-based inflation, significant supply chain disruption, including higher operating costs to meet strong consumer demand, and the unfavorable comparison to a $16 million strategic asset investment program benefit recorded in the segment in the first quarter of 2020.

Adjusted operating income totaled $1.52 billion, compared to $1.51 billion in the year-ago period and, on a constant currency basis, Adjusted operating income decreased 0.4%. On a percent of net sales basis, Adjusted operating income in 2021 was 32.1%, compared to 34.2% in the prior year, largely due to the timing of pricing in the market lagging inflation, as well as the costs of supply chain disruption in the fourth quarter not being fully offset by productivity.

Packaged beverages

Net sales for the full year of 2021 increased 9.7% to $5.88 billion, compared to $5.36 billion in the year-ago period. On a constant currency basis, net sales increased 9.5%, reflecting favorable volume/mix of 6.0% and higher net price realization of 3.5%. This strong performance reflected continued market share growth across the portfolio, with particular strength in CSDs, coconut water, apple juice, and apple sauce.

Driving the strong net sales performance were Canada Dry, Sunkist, Dr Pepper, A&W, 7UP and Squirt CSDs, as well as growth in Mott's, Polar seltzers, Vita Coco, and Snapple, partially offset by a decline in Hawaiian Punch.

GAAP operating income increased 22.9% to $1.01 billion in 2021, compared to $0.82 billion in the prior year, reflecting the strong growth in net sales, continued productivity and merger synergies and the net year-over-year benefit of $44 million recorded in the segment from the Company's strategic asset investment program. Also benefitting the comparison was the favorable year-over-year impact of items affecting comparability, including lower costs related to COVID-19 and comparison to a non-cash impairment charge in the prior year. Partially offsetting these drivers were the impacts of broad-based inflation, significant supply chain disruption, including higher operating costs to meet strong consumer demand, and increased marketing investment.

Adjusted operating income increased 8.6% to $1.11 billion, compared to $1.02 billion in the prior year and, on a constant currency basis, Adjusted operating income increased 8.3%. On a percent of net sales basis, Adjusted operating income was 18.9% in 2021, compared to 19.0% in the prior year, reflecting the strong growth in net sales offset by the combined impacts of inflation, increased marketing investment and higher costs to meet consumer demand, which were not fully offset by productivity.

Beverage concentrates

Net sales for the full year of 2021 increased 12.2% to $1.49 billion, compared to $1.33 billion in the prior year. On a constant currency basis, net sales increased 11.7%, reflecting favorable volume/mix of 2.0% and higher net price realization of 9.7%. The volume/mix performance was fueled by the benefit of significantly increased marketing investment and improving trends versus the prior year in the fountain foodservice business, as consumer mobility in the restaurant and hospitality channels increased.

Total shipment volume increased 1.1% in 2021 versus the prior year, driven by growth in Dr Pepper, A&W and Crush, partially offset by lower shipment volume in Canada Dry. Bottler cases sales volume in 2021 increased 2.0% versus the prior year.

GAAP operating income for the full year increased 12.0% to $1.04 billion, compared to $0.93 billion in the year-ago period, reflecting the higher net sales, partially offset by significantly higher marketing investment and a slightly unfavorable year-over-year impact of items affecting comparability.

Adjusted operating income increased 12.5% to $1.06 billion for the full year of 2021, compared to $0.94 billion in the prior year and, on a constant currency basis, Adjusted operating income increased 11.9%. On a percent of net sales basis, Adjusted operating income increased 20 basis points to 71.0% in 2021, compared to 70.8% in the prior year, largely reflecting the strong growth in net sales, partially offset by the significantly higher marketing investment.

Latin America beverages

Net sales for the full year of 2021 increased 20.5% to $599 million, compared to $497 million in the prior year and, on a constant currency basis, net sales increased 14.1%. This performance was driven by higher volume/mix of 7.3%, fueled by significantly higher marketing investment, and higher net price realization of 6.8%. Leading the strong growth in net sales were Peñafiel and Clamato.

GAAP operating income for the full year increased 26.7% to $133 million, compared to $105 million in the year-ago period, reflecting the growth in constant currency net sales, continued productivity and the favorable year-over-year impact of items affecting comparability. These positive drivers were partially offset by inflation and the significant increase in marketing investment.

Adjusted operating income increased 25.0% in 2021 to $135 million, compared to $108 million in the prior year and, on a constant currency basis, Adjusted operating income increased 19.4%. On a percent of net sales basis, Adjusted operating income increased 80 basis points in 2021 to 22.5%, compared to 21.7% in the prior year, primarily driven by the strong growth in net sales.

Fourth-quarter consolidated results

Net sales for the fourth quarter of 2021 increased 8.7% to $3.39 billion, compared to $3.12 billion in the year-ago period, primarily reflecting exceptionally strong growth in Packaged Beverages, along with strong growth in Beverage Concentrates and Latin America Beverages. On a constant currency basis, net sales advanced 8.5%, reflecting higher volume/mix of 4.4% and favorable net price realization of 4.1%. On a two-year basis, constant currency net sales advanced 15.7% versus 2019.

KDP in-market performance in the LRB category remained strong in the quarter, with retail dollar consumption advancing 12.6% across the Company's cold beverage retail base, largely reflecting strength in CSDs, premium unflavored water, coconut water, apple juice, and apple sauce. This performance was driven by Dr Pepper, Sunkist, Canada Dry, A&W and Squirt CSDs, CORE Hydration and Evian premium water, Vita Coco, Polar seltzers, and Mott's. On a two-year basis, KDP gained market share in 83% of its cold beverage retail base and grew consumption of its cold beverage portfolio by 27%.

In coffee, retail dollar consumption of single-serve pods manufactured by KDP in IRi tracked channels increased 3.4%, driven by growth in partner brands and KDP owned and licensed brands, partially offset by a decline in private label pods manufactured by KDP. KDP manufactured share remained strong, advancing 60 basis points to 83.5% in the quarter. Performance in the away-from-home business improved versus the year-ago shelter-in-place environment, although the increase in overall consumer mobility has not yet fully translated into a broad return to offices. On a two-year basis, retail consumption of single-serve pods manufactured by KDP increased 11.2% in IRi tracked channels.

GAAP operating income increased 3.6% to $725 million in the fourth quarter of 2021, compared to $700 million in the year-ago period, reflecting the benefits of the strong growth in net sales, productivity, merger synergies and a strategic asset investment program benefit of $70 million in the quarter. Partially offsetting these positive drivers were the impacts of broad-based inflation and significant supply chain disruption across manufacturing, logistics, material inputs and labor availability. Also impacting the comparison was increased marketing investment and the unfavorable year-over-year impact of items affecting comparability.

Adjusted operating income in the quarter grew 6.1% to $910 million, compared to $858 million in the year-ago period. Adjusted operating margin was 26.8% in the quarter, compared to 27.5% in the year-ago period. On a two-year basis, fourth quarter Adjusted Operating income advanced 11.9% versus 2019. On a constant currency basis, Adjusted operating income grew 5.9% in the fourth quarter versus year-ago.

GAAP net income in the fourth quarter of 2021 increased 97% to $843 million, or $0.59 per diluted share, compared to GAAP net income of $428 million, or $0.30 per diluted share, in the year-ago period. This performance was driven by the growth in operating income, lower interest expense and a lower effective tax rate. Also benefitting the performance was the favorable year-over-year impact of items affecting comparability, including the aforementioned $400 million after-tax gain on the sale of the Company's equity interest in BodyArmor and comparison to a non-cash impairment charge in the prior year.

Adjusted net income advanced 15.5% to $640 million in the fourth quarter of 2021, compared to $554 million in the year-ago period. Adjusted diluted EPS increased 15.4% to $0.45, compared to $0.39 in the year-ago period. On a two-year basis, Adjusted diluted EPS in the quarter grew 28.6% versus 2019.