Sodexo Q1 2021: Sales Drop Over 20%, H1 UOP Margin Assumption Upgraded, Revenue in line with Guidance

Source Sodexo/GlobalNewswire

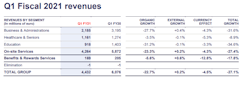

- Revenue organic growth at -22.7%, and -21.5% excluding Rugby World Cup base effect

- Improving trend in Q1 Fiscal 2021 versus Q4 Fiscal 2020 in all segments and activities

- Strong performance on contract negotiations and cost control

- H1 Fiscal 2021 Underlying operating profit margin assumption upgraded to at least 2.5%

Issy-les-Moulineaux, January 8, 2021 - Sodexo (NYSE Euronext Paris FR 0000121220-OTC: SDXAY).

Commenting on these figures, Sodexo chief executive Denis Machuel said:

"The revenue trend has improved again this quarter, despite the start of the second wave in November in most of our geographies. All regions were better, even though the North American activities remain very impacted by the Covid-19 pandemic, especially in Education, Corporate Services and Sports & Leisure.

The teams have been very actively adapting cost structures and contract terms to ensure that ramping up contracts is profitable. The restructuring program is moving forward.

As a result, although revenues are in line with guidance, this first quarter has been better than expected in terms of operating performance, and so despite the uncertainty around the evolution of the Covid-19 pandemic, our first half Fiscal 2021 Underlying operating profit margin target is now to be at least 2.5%.”

HIGHLIGHTS OF PERIOD

- First quarter Fiscal 2021 revenue organic decline was -22.7%, and -21.5% excluding the Rugby World Cup (RWC) event in Q1 Fiscal 2020. So, the trend has improved since the previous quarter which was down -24.9%.

- On-site Services organic revenue decline of -23.3%, and -22.1% excluding the RWC effect, reflected an improvement in all segments relative to the previous quarter which was down -25.4%. The key quarter on quarter trend improvements were:

- A +2.1-point improvement in Business & Administrations in the first quarter relative to the fourth quarter Fiscal 2020, or +4.2 points excluding the RWC, is due to a clear improvement in trend in Corporate Services in Europe in September and October, somewhat offset by a weaker November impacted by the second wave, and continued strength in Government & Agencies and Energy & Resources (together up +5.5%), with particularly strong activity in the mining sector. Sports & Leisure globally remained very weak, even though the trend, excluding the RWC effect, improved by +6 points in Q1 versus Q4 last year. North America remained very impacted by the pandemic.

- The +5.6-point improvement in Healthcare & Seniors was from some cross-selling of extra services and ramp-up of the significant rapid testing centers contract in the UK. Retail sales remained weak due to the pandemic.

- A +4.5-point improvement in Education reflecting the reopening of Schools in Europe, while activity remains very weak in schools and universities in North America.

- Geographically, activity in North America was down -33.1%, while outside North America the trends improved with Europe down -19.8%, or -16.6% excluding the RWC, and the Asia-Pacific, Latam, Middle East and Africa region stabilizing at -1.4%, with China and Latin America compensating for the more difficult markets in Asia, Africa and the Middle East.

- Benefits & Rewards Services organic revenue decline was -5.6%, with continued improvement in the trend in Europe at -3.2%, while the decline in Latin America remained at -9.4%, due to falling interest rates and a competitive environment in Brazil.

- The Tokyo Olympic Games contract is still being renegotiated. The outcome of these negotiations will dictate the level and speed of the reimbursement and/or confirmation of the hospitality packages.

- Sodexo joined CDP’s A List of global climate change leaders with key progress on its carbon strategy and has been awarded with a platinum rating by EcoVadis, placing us in the top 1% of the most virtuous companies. We continue our efforts to halve food waste within our operations by 2025, mainly through our WasteWatch program. Sodexo launched its first Sodexo Food Waste Consumer Insights Report to better understand the food waste behaviors of students and working adults and raised awareness through its WasteLESS Week annual campaign.

OUTLOOK

In the next quarter, given the high level of uncertainty which we are currently experiencing, the effects of the pandemic, and particularly the possibility of further lockdowns, will continue to be significant for the Group.

The Government & Agencies and Energy & Resources segments will continue to be resilient. Healthcare & Seniors are progressively returning to pre-Covid level. Corporate Services and Education will see activity improving progressively as lockdowns become less severe and vaccination becomes more prevalent. Sports & Leisure is unlikely to improve significantly until the pandemic is over.

In Benefits & Rewards Services, Employee benefits issue volumes have returned to growth as digitalization and market penetration continue to progress, strengthened by working from home trends. Reimbursement patterns are still being affected by restaurant closures, but they will catch up with issue volumes as and when restaurants re-open. Revenues continue to be impacted by extremely low interest rates, particularly in Brazil, which have now stabilized.

At this stage, after the first quarter performance, we maintain our guidance for an organic decline of between -20% and -25% for the first half Fiscal 2021, improving relative to the second half Fiscal 2020.

Until activity returns to more normal levels, the Group is still using all available furlough programs. Strong restructuring measures have been and continue to be taken to protect margins going forward, as government support falls away. Detailed work is being conducted across the board in all segments and activities to reduce SG&A.

First quarter Fiscal 2021 performance has been better than expected in terms of cost control and contract negotiations, and so, despite the uncertainty around the evolution of the pandemic, our first half Fiscal 2021 Underlying operating margin target is now for at least 2.5%, better than our original assumption of between 2 and 2.5%.

Looking further out, on the basis that the pandemic will be over by 2021 calendar year end, the Group aims to return to sustained growth and to rapidly increase the Underlying operating margin back over the pre-Covid level.

Click here to see Sodexo's full Q1 report.