Kraft Heinz Reports Fourth Quarter And Full Year 2018 Results

Source The Kraft Heinz Company

February 21, 2019 05:01 PM Eastern Standard Time

PITTSBURGH & CHICAGO--(BUSINESS WIRE)--The Kraft Heinz Company (NASDAQ: KHC) (“Kraft Heinz” or the “Company”) today reported fourth quarter and full year 2018 financial results reflecting solid organic net sales growth in all segments that was more than offset by higher operating costs, as well as non-cash impairment charges related to goodwill and intangible assets.

“Our fourth quarter and full year 2018 results reflect our commitment to re-establish commercial growth of our iconic brands, turn around consumption trends in several key categories, and expand into new category and geographic whitespaces," said Kraft Heinz CEO Bernardo Hees. "We are pleased with those actions, the returns on our investments, and the momentum built for 2019. However, profitability fell short of our expectations due to a combination of unanticipated cost inflation and lower-than-planned savings. Going forward, our global focus will remain on leveraging our in-house capabilities, developing our talented people, and delivering top-tier growth at industry-leading margins."

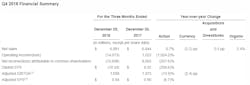

Net sales were $6.9 billion, up 0.7 percent versus the year-ago period, including an unfavorable 2.2 percentage point impact from currency and a net 0.5 percentage point benefit from acquisitions and divestitures. Organic Net Sales(1) increased 2.4 percent versus the year-ago period. Pricing was down 1.6 percentage points, as increased promotional activity and pricing to reflect lower key commodity(2)costs in North America, particularly the United States, more than offset higher pricing in EMEA and Rest of World markets. Volume/mix increased 4.0 percentage points, driven by a combination of strong consumption gains in North America and condiments and sauces growth across Latin America, North America, and EMEA.

During the fourth quarter, as part of the Company's normal quarterly reporting procedures and planning processes, the Company concluded that, based on several factors that developed during the fourth quarter, the fair values of certain goodwill and intangible assets were below their carrying amounts. As a result, the Company recorded non-cash impairment charges of $15.4 billion to lower the carrying amount of goodwill in certain reporting units, primarily U.S. Refrigerated and Canada Retail, and certain intangible assets, primarily the Kraft and Oscar Mayer trademarks. These charges resulted in a net loss attributable to common shareholders of $12.6 billion and diluted loss per share of $10.34.

Adjusted EBITDA decreased 13.9 percent versus the year-ago period to $1.7 billion, including a negative 2.4 percentage point impact from currency. Excluding the impact of currency, lower Adjusted EBITDA reflected a decline in the United States that more than offset Constant Currency Adjusted EBITDA(1) growth in all other business segments. Adjusted EPS decreased 6.7 percent to $0.84, as lower Adjusted EBITDA, higher depreciation and amortization expenses, as well as higher interest expense more than offset lower taxes on adjusted earnings in the current period.