Crane Co. delivers strong Q2; sales in Payment and Merchandising Technologies rise 33%

Source Crane Co.

Crane Co. (NYSE: CR), a diversified manufacturer of highly engineered industrial products, reported second-quarter 2021 financial results and updated its full-year 2021 outlook.

“We delivered another quarter of exceptionally strong results with record adjusted operating margins of 17.6% and record adjusted EPS," said Crane Co. president and chief executive Max Mitchell.

"All three of our strategic growth platforms continue to perform extremely well, and we continue to see strengthening underlying trends in our primary end markets as reflected in our core year-over-year order growth of 45% and core year-over-year backlog growth of 7%," he added.

KEY POINTS

- GAAP earnings from continuing operations per diluted share (EPS) of $1.87 compared to $0.23 in the second quarter of 2020.

- Excluding Special Items, record EPS from continuing operations of $1.83 increased 205% compared to $0.60 in the second quarter of 2020.

- Core year-over-year sales growth of 19% and core year-over-year order growth of 45%.

- Raising GAAP EPS from continuing operations guidance to $6.05-$6.25, from $5.75-$5.95.

- Raising EPS from continuing operations guidance, excluding Special Items, to $5.95-$6.15, from $5.65-$5.85.

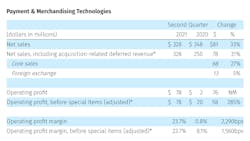

Sales in the Payments and Merchandising Technologies' segment increased $81 million to $328 million, or 33%, driven by a $68 million, or 27%, increase in core sales, and a $13 million, or 5%, benefit from favorable foreign exchange.

Payments and Merchandising's operating profit margin increased to 23.7%, from 0.8% last year, primarily reflecting higher volumes, favorable mix, the non-recurrence of repositioning charges, and benefits from 2020 cost actions. Excluding Special Items, operating profit margin increased to 23.7%, from 8.1% last year.

Crane has four business segments: Aerospace & Electronics, Process Flow Technologies, Payment & Merchandising Technologies, and Engineered Materials. On May 24, 2021, the company announced that it had signed an agreement to divest its Engineered Materials segment.