Crane Co.’s first-quarter results improve, payment and merchandising sales rise 13%

Source Crane Co.

KEY POINTS

- GAAP earnings per diluted share was $1.84.

- EPS of $1.66 increased 44%, compared with $1.15 in the first quarter of 2020.

- GAAP EPS guidance rises to $5.75-$5.95 from $4.95-$5.15.

- EPS guidance increases to $5.65-$5.85 from $5-$5.20.

Crane Co. (NYSE: CR), a diversified manufacturer of highly engineered industrial products – including vending machines, coffee equipment and payment systems – reported first-quarter 2021 financial results and updated its full-year 2021 outlook.

Companywide, encompassing four industrial segments, Crane Co.’s first-quarter 2021 sales were $834 million, an increase of 5% over 2020’s first quarter.

The sales increase was comprised of a $25 million, or 3%, benefit from favorable foreign exchange, a $5 million, or 1%, increase in core sales, and a $5 million, or 1%, benefit from an acquisition.

First quarter 2021 operating profit was $146 million, compared to $89 million in the first quarter of 2020.

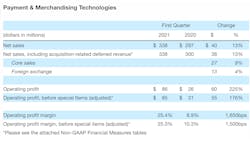

Payment & Merchandising Technologies

In Crane's Payment & Merchandising Technologies segment, which includes Crane Payment Innovations, sales in the first quarter were $338 million, increasing $40 million, or 13%.

Crane said sales were driven by a $27 million, or 9%, increase in core sales, and a $13 million or 4%, benefit from favorable foreign exchange.

The division’s operating profit margin increased 25.4%, from 8.9% last year, primarily reflecting continued strong performance at Crane Currency, productivity and benefits from 2020 cost actions.

Excluding special items, the division’s operating profit margin increased 25.3%, compared with 10.3% last year.

Payments & Merchandising is one of four industrial segments in the Crane Co. family of companies, which also comprises Fluid Handling, Aerospace & Electronics and Engineered Materials.

“We delivered exceptionally strong results in the first quarter, said Crane Co. president and chief executive Max Mitchell. “Each of our three global strategic growth platforms delivered robust results ahead of expectations, with Crane Currency driving the most substantial outperformance in the quarter.”

Crane acquire Boston-based Crane & Co. Inc., the parent of Crane Currency, for $800 million at the end of 2017.