General Mills Reports Results For Fiscal 2019 And Outlines Growth Goals For Fiscal 2020

Source General Mills

June 26, 2019 07:00 AM (EDT)

MINNEAPOLIS--(BUSINESS WIRE)--General Mills (NYSE: GIS):

Full-year Highlights

- Net sales increased 7 percent to $16.9 billion, and were up 9 percent in constant currency¹; organic net sales were in line with last year

- Operating profit increased 4 percent; adjusted operating profit increased 10 percent in constant currency

- Diluted earnings per share (EPS) of $2.90 declined 20 percent from the prior year that included one-time benefits from U.S. tax reform; adjusted diluted EPS of $3.22 increased 4 percent in constant currency

- Strong cash conversion enabled the company to pay $1.2 billion in dividends while reducing debt by $1.3 billion

¹ Please see Note 7 to the Consolidated Financial Statements below for reconciliation of this and other non-GAAP measures used in this release.

General Mills today reported results for the fourth quarter and full fiscal year ended May 26, 2019. Financial results for fiscal 2019 include contributions from Blue Buffalo Pet Products, Inc. (“Blue Buffalo”), which was acquired on April 24, 2018.

“I’m pleased to say that we executed well, successfully transitioned Blue Buffalo into our portfolio, and delivered our financial commitments in fiscal 2019,” said General Mills Chairman and Chief Executive Officer Jeff Harmening. “We’ll look to improve our performance again in fiscal 2020, and we have plans in place to accelerate our organic sales growth while maintaining our strong margins and cash discipline.”

General Mills is pursuing its Consumer First strategy and executing against its global growth framework to drive consistent topline growth: 1) competing effectively through strong innovation, effective consumer marketing, and excellent in-store execution; 2) accelerating growth on its four differential growth platforms including Häagen-Dazs ice cream, snack bars, Old El Paso Mexican food, and its portfolio of natural and organic food brands; and 3) reshaping its portfolio through growth-enhancing acquisitions and divestitures, including the acquisition of Blue Buffalo, the leading brand in the fast-growing wholesome natural pet food category in the U.S. By combining consistent topline growth, margin expansion, and disciplined cash conversion and cash returns, General Mills expects to generate top-tier total shareholder returns over the long term.

Fourth Quarter Results Summary

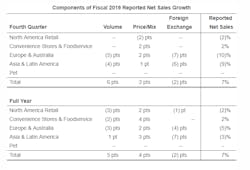

- Net sales increased 7 percent to $4.16 billion and were up 9 percent in constant currency, driven primarily by the addition of Blue Buffalo. Organic net sales declined 1 percent, reflecting lower contributions from organic volume. Organic net sales declines in North America Retail and Europe & Australia segments were partially offset by growth in Convenience Stores & Foodservice and Asia & Latin America.

- Gross margin declined 140 basis points to 35.1 percent of net sales. Adjusted gross margin, which excludes certain items affecting comparability, declined 50 basis points to 35.3 percent, driven by higher input costs.

- Operating profit totaled $716 million, up 34 percent from last year due primarily to lower restructuring, impairment, and other exit costs and the addition of Blue Buffalo, partially offset by lower gross margin. Adjusted operating profit of $722 million increased 5 percent in constant currency, primarily driven by the addition of Blue Buffalo, partially offset by lower adjusted gross margin. Operating profit margin of 17.2 percent increased 340 basis points. Adjusted operating profit margin decreased 50 basis points to 17.3 percent.

- Net earnings attributable to General Mills totaled $570 million compared to $354 million a year ago, reflecting higher operating profit and lower taxes and interest expense.

- Diluted EPS of $0.94 was up 59 percent from the prior year. Adjusted diluted EPS totaled $0.83 in the fourth quarter, up 6 percent from the prior year in constant currency, driven primarily by a lower adjusted effective tax rate and higher adjusted operating profit, partially offset by higher interest expense and higher average diluted shares outstanding in the quarter.

Full Year Results Summary

- Net sales increased 7 percent to $16.86 billion and were up 9 percent in constant currency, driven by the addition of Blue Buffalo. Organic net sales essentially matched year-ago levels, with 2 points of positive net price realization and mix offset by lower contributions from volume. Organic net sales growth in the Asia & Latin America and Convenience Stores & Foodservice segments was offset by declines in North America Retail and Europe & Australia.

- Gross margin decreased 40 basis points to 34.1 percent of net sales. Adjusted gross margin was down 10 basis points to 34.4 percent.

- Operating profit totaled $2.52 billion, up 4 percent from the prior year. Constant-currency adjusted operating profit increased 10 percent. Operating profit margin of 14.9 percent was down 50 basis points. Adjusted operating profit margin increased 30 basis points to 16.9 percent.

- Net earnings attributable to General Mills totaled $1.75 billion.

- Diluted EPS of $2.90 was 20 percent below prior-year levels, primarily driven by one-time benefits from U.S. tax reform in the prior year. Adjusted diluted EPS of $3.22 was up 4 percent on a constant-currency basis.