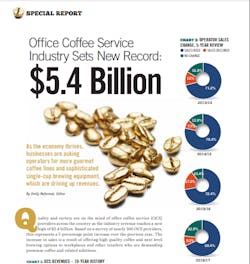

Office Coffee Service Industry Sets New Record: $5.4 Billion

Click here to review the charts and full print version.

Quality and variety are on the mind of office coffee service (OCS) providers across the country as the industry revenue reaches a new high of $5.4 billion. Based on a survey of nearly 100 OCS providers, this represents a 5 percentage point increase over the previous year. The increase in sales is a result of offering high quality coffee and next level brewing options to workplaces and other retailers who are demanding premium coffee and related solutions.

Year over year sales growth

Nearly a quarter of the OCS providers surveyed reported an increase in sales from 2017 to 2018, higher than last year, but in line with previous years (chart 2). The regions that saw the most growth were the East and West coasts, while the Midwest felt a decline when reports were averaged together (chart not shown). The reason for the declines were cited as accounts being lost to competitors as well as local industries, such as oil, closing. Growth was attributed to the steady economy, which leads business and industry locations to spend more on services such as coffee for employees. OCS providers report that these locations are putting a large emphasis on single cup systems, especially bean to cup brewers. Customers are looking for on-demand hot beverage options as well as a wide range of drink options.

A majority of OCS providers also invested in more aggressive sales and marketing strategies, according to feedback. It was the second most reported reason for change after bean to cup machines. It is also reflected in the greater percentage of providers who added staff this past year, 57.1 percent, compared to 46 percent the year before (chart 11).

Online marketing is playing a role in sales as well. This was the first year all respondents reported having a website, and 50 percent offered online ordering on that site (chart 13). In previous years, 2 to 3 percent did not have a website for their OCS company.

Green coffee prices drop

According to reports from the International Coffee Organization, the price of green coffee has fallen 4.5 percent since last August (chart 3). As of when this report was written, the August 2018 price of green coffee was 102.41 cents per pound. This is the lowest price it has been for the last few years, helping balance price increases reported by operators related to plastic and transportation costs. It’s also driving OCS providers to purchase green coffee themselves and have it roasted into private label brands.

Private label was extremely popular this past year, with 42.1 percent of operators calling it the top-selling OCS product by volume (chart 5C). It also made up the highest percentage of coffee revenue compared to other types of coffee (chart 5A).

While there are private label pods, most private label coffee is used in traditional pot brewers. This year, automatic glass pots saw an increase in installs, reaching 31.0 percent, an increase of 10.1 percentage points (chart 6) over the prior year. Part of this increase is likely due to providers adding convenience stores as customers (chart 9).

Demand for on-demand

Single-cup brewers saw an increase in placements for 2017 to 2018, representing 22.4 percent of the equipment placed (chart 6). This is one of the highest on record nearing the 2014/2015 high of 23.2 percent. Based on comments from operators, many of those are bean-to-cup brewers. A majority said adding bean-to-cup brewers drove up profits. However, sales of whole beans didn’t increase substantially. There are several reasons for this. Some locations might be upgrading from one type of bean-to-cup brewer to another, changing the equipment but not the product use. Another might be that with the low cost of green coffee, the increase in whole beans is not reflected as a percentage of sales, but is in other ways. Whole beans was chosen as the top-seller by volume by 15.8 percent of operators, an increase from the 6.5 percent from the year before.

Coffee nearly half the ticket

Despite how coffee was delivered to the end consumer, as a percentage of revenue it jumped up to 46.9 after a drop last year. It’s likely an anomaly that coffee sales dropped to 35 in 2016/2017 as comments were positive about sales. The way the question was asked was changed, as well as how the different types of coffee product and service were reported last year, creating some difficulty comparing previous years to the current year.

Looking at the 2017/2018 chart, allied products continue to be a strong segment, especially creamers and non-coffee hot beverages. Both grow from the previous year. Placing nationally known names and premium products in this category was a strategy many OCS providers reported using successfully in comments.

Low unemployment grows locations

It would be impossible to talk about OCS without mentioning employment rates. In August 2018 alone, over 200,000 jobs were created in a variety of industries, according to the U.S. Department of Labor. Locations are adding employees, in many cases driving up the number of people served at each location (chart 8). OCS providers reported more locations with over 20 employees, with increases especially in the 20 to 49 and 75 to 99 range.

Ice increases with cold coffee

This year providers were asked if they provided ice machines to customers. Less than half, 44.4 percent said yes, higher than the 38.6 from the previous year (chart not shown). When the operators who also offered iced coffee or cold brew were considered, that percentage rose to 75 percent showing a positive correlation. Even cold brew drinks increased the number of ice machines installed as many consumers, especially Millennials, will drink that beverage over ice as well.

Water filtration makes its mark

More operators reported adding water filtration as an environmental option as well as new service this year. When asked about sustainable offerings, 44.4 percent said they provided water filtration systems to eliminate the negative impact of bottled water. That was an increase from the year before when the number was 25 percent. It was also the most common product with recyclable or compostable coffee pods being the second most common product offered, chosen by 27.8 percent.

Further evidence that water filtration is an upcoming segment for OCS is the number of providers who added it in 2017/18. It was the most added service at 19.1 percent (chart 10).

Despite the popularity of water, ice and other hot drinks, coffee is a well-liked non-alcoholic beverage. Companies that traditionally focused on cold drinks are recognizing the advantage of coffee and moving to position themselves in the market. The Coca-Cola Company recently announced its acquisition of Costa coffee, a leading U.K. coffee brand name, and earlier this year Dr Pepper and Keurig Green Mountain became one company with an eye towards offering more options to consumers.

In the coffee service industry revenues continue to increase as the economy keeps businesses optimistic and wanting to entice good employees with morale boosting OCS. Upgrading service in the break room is a way to present the best image, driving up revenues.

Emily Refermat

Emily began covering the vending industry in 2006 and became editor of Automatic Merchandiser in 2012. Usually, Emily tries the new salted snack in the vending machine, unless she’s on deadline — then it’s a Snickers.

Emily resigned from Automatic Merchandiser and VendingMarketWatch.com in 2019 to pursue other opportunities.