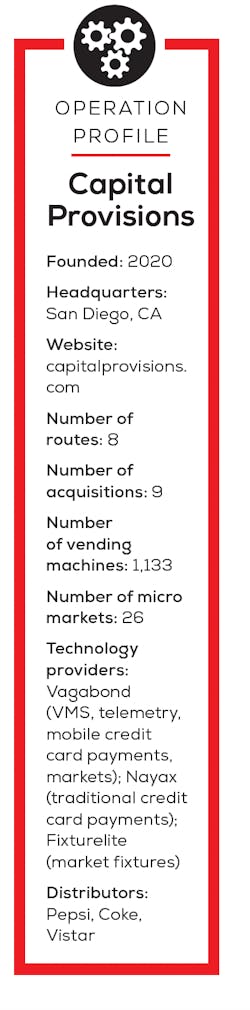

Capital Provisions engages customers and leverages data to operate like a retailer

“We’re here to produce profit, not just revenue, which runs counter to the way most traditional operators run their businesses but is at the heart of our team’s success,” said Lovett. That team, he gushes, includes Chris Watson and Franco Benitez, the company’s leaders in the field, who are supported by individuals skilled in finance, technology and operations who have extensive experience in the space, an entrepreneurial mindset and an absolute drive to succeed.

One of the things that makes the San Diego-based team’s not-so-conventional approach possible is its use of technology, primarily Vagabond’s software, telemetry and mobile payments products that together increase sales, connect machines and maximize operational efficiencies.

The Capital Provisions team is able to apply these technologies to their fullest capabilities in part because it was Lovett himself who founded Washington, D.C.-based Vagabond about a decade ago, prompted by his first venture as a vending machine operator. He’s still on the board of Vagabond, but with the launch of Capital Provisions, is once again an operator but on a much grander scale. He’s encouraging the hundreds of operators using Vagabond’s platform to follow his lead in the way Capital Provisions leverages it to achieve unprecedented results in their business and is also hot on the acquisition trail to continue to expand his own.

Behind the scenes

First and foremost, Capital Provisions doesn’t operate unconnected sale points, because according Lovett, if it’s not worth the cost of connecting, it’s not worth the cost of servicing.

Capital Provisions planograms every coil to the flavor and makes merchandising changes every visit – either par value, product or price – to match supply with demand.

“Most operators think we’re crazy to spend what they see as too much time merchandising at every visit. But they also call people who drive ‘drivers,’” Lovett remarked. “We call them service representatives, and they are at the top of our organizational chart. They’re the face of the company and can enact the most change. We work hard to put every piece of data at their fingertips so they can make hundreds of minor changes every day with no two planograms or pricing being the same in order to ensure the supply in each sale point matches the demand of the consumers who frequent it.”

Leveraging data

The team uses Vagabond to guide merchandising decisions to make changes daily to par value, price or selection with highly detailed data on what product is most successful at a particular price point and in what type of location for every sale point and every SKU.

Prekitting based on real-time sales data tailored to each machine allows the service reps to simply show up to the warehouse in the morning, turn the key, and they’re off. And with no predetermined routes or schedules, anyone can service any vending machine or market.

Service reps only go when needed, and with machines merchandised to intentionally not sell out too quickly and last longer between visits, labor, gas and truck costs are kept to a minimum, which are the second, third and fourth highest expenses after product cost, Lovett pointed out.

“Vagabond’s telemetry network delivers real-time business intelligence to our team in the field to ensure we dispatch our team wherever they are needed at the right time,” he said.

One size doesn’t fit all

Capital Provisions works with Vagabond to merchandise the best mix of products across the operation to limit the amount of SKUs stocked in its warehouse and determine the type of places where each has the highest profit margin.

“One product may sell for one price point in a hospital, another in a college and another in an office,” Lovett instanced. “The only way to do it right is to put data in the hands of the service reps. We spend more time at each sale point than most operators, but because we do, it lasts one more visit than it would otherwise, which is why we team with highly professional sales reps. We would rather have a smaller team of high-caliber professionals that we compensate for their skill, commitment and partnership taking the time to do it right, tailoring products to consumers at each location, than a bigger team of less dedicated people who we pay less.”

Consumer driven

Also less common in unattended retail is that Capital Provisions directly engages its consumers using Vagabond’s backend platform in order to guarantee the best service and product selection possible to them.

“This provides consumers a beautiful buying experience and enables our team to engage with them,” Lovett explained. “And, it allows us to influence them to buy high-margin products, products that generate high rebates for us, or products that are nearing expiration. This is where we are different than most operators. We even hold ‘happy hours’ during slow times by alerting consumers to temporarily reduced prices. This brings them back to the sale point for a ‘mixer,’ and they buy multiple items while they’re there.”

Engaging consumers and using their preference data to influence what they buy through marketing and advertising works in the convenience services industry just as it does in all others, Lovett emphasized.

“Why would we still think vending has to be solely an impulse purchase when technology exists to drive consumers back to the sale point and encourage them to buy from us?” he asked. “Matching supply with demand specific to each sale point maximizes revenues, margins and consumer satisfaction. Ours is the last industry that doesn’t know who’s actually buying. Most vending operators never even think about marketing to consumers or using consumer preference data to determine what to sell them. Every other industry on the planet does and we can too.”

The backstory

Lovett, a serial entrepreneur, entered vending from a finance background and a career that’s always been rooted in technology. “Even Capital Provisions is a technology company,” Lovett stated.

His first business startup was Critical Network Productions, a network integrator that was sold to Swisscom, the Swiss telephone company. Next, he launched CirrusWorks, a maker of network performance hardware for large buildings that is reportedly in due diligence to be sold to a Fortune 500 technology company.

In 2012, Lovett ventured into vending, which intrigued him because he was convinced that “a little tech could go a long way.” Lovett created algorithms and operational methodologies that became the springboard for starting up Vagabond in 2013.

“When I bought my first vending machines to support me while starting my second business, it was also out of curiosity for what seemed to be the untapped potential of what could be done with vending,” said Lovett.

He operated 10 vending machines that generated $9,000 per machine per year in revenue through an operational method that became Vagabond and soon sold his vending machines to focus on the technology startup in partnership with Juan Jorquera, Bonnie Trush and Mohammad Torabinejad, names no doubt many operators will recognize.

“With Vagabond, we created a network that supports hundreds of small operators across the U.S. that generate an average of $6,500 per sale point per year, roughly twice the industry’s average, because of the operational methodologies that Capital Provisions demonstrates and Vagabond enables,” he said. “As long as they use the technology and methodology, it pays off.”

Upon introducing Vagabond, Lovett found that many of the operators that wanted to deploy the technology were undercapitalized and couldn’t afford the investment required to procure equipment, install it and train their teams. So in 2015, he partnered with Rich Boone, a long-time friend and lawyer based in New York City, to found Legend Capital, a small private equity firm that has since made investments into over 100 vending operators across the country.

Then in 2018, Legend Capital partnered with Jim Koehr of Sorin Capital Funds and Kyle Loughran, a driven entrepreneur with a finance background, to found Legend Foods, which became a large operator rollup on the East Coast. Lovett later sold his interest in the business.

Capital Provisions starts up

In 2020, Lovett identified Southern California as a fragmented market with many small operators ripe for consolidation. Legend Capital launched Capital Provisions with several partners, including some of the same team that had created Legend Foods on the East Coast, and embarked on the eight small acquisitions that comprised the initial platform.

“Simply servicing accounts properly produces a significant increase in revenues since acquired machines are often empty,” Lovett said. “We do not have to add infrastructure upon small acquisitions, so they drop much of their revenue to our bottom line. New sale points increase route density, so our operating processes are more effective.”

Coming out of the integration phase, Lovett said Capital Provisions has achieved 50% revenue growth in the first quarter of 2022. The number-one reason is that the company is bigger, with more buying power and denser routes, coupled with connected machines, cashless payments, dynamic routing and scheduling, and all the other benefits brought by the use of Vagabond and other technology upgrades.

“Capital Provisions started during the pandemic, in today’s world, not in 2019’s world,” Lovett commented. “We don’t care what happened before. We see higher margins and revenues and only an upward trajectory. The news has everyone believing everyone works from home. The reality is 162 million people work in America and 100 million never stopped working at their workplace, even in the spring of 2020, and there’s as much opportunity as ever.”

He added that in locations of all kinds – from warehouses to schools to hospitals and factories – many people can’t work remotely. From Vagabond’s data, in April 2020, vending revenue was down 71%, according to Lovett. A few months later, it was back to 60% of pre-pandemic levels, and now vending revenue has returned to 85% to 90% of 2019’s figures.

The sky’s the limit

“The market is enormous and we are growing organically and by acquisitions, which are two highly related strategies since acquisitions accelerate organic growth opportunities,” according to Lovett. “The biggest and fastest impact to our bottom line is buying smaller companies and ‘tucking them in.’ Buying a small ‘tuck-in’ can drop up to 30% of the acquired revenue to the bottom line because when their trucks show up at our warehouse, their revenues are very quickly increased to our operating margins without adding additional infrastructure.”

According to Lovett, the Southern California workforce spends about $35 billion annually on food and beverages during the workday. That’s about $3,000 per year per individual, or about $12 a day.

“Our industry is getting only about $1.8 billion of that in Southern California,” he said. “This is primarily because smaller operators are focused on selling snacks and drinks out of vending machines because they’re too small to operate markets, so the majority of the spend – $33 billion – is heading around the corner to the local deli. We only need a smidge of that to substantially increase revenues and margins. You can’t do it unless you have markets and bill them a fair price for the food that they actually want to eat. You have to offer better than typical vending fare while managing theft, spoilage and menu rotation.”

Micro market conversions

This is why Capital Provisions converts every possible location with vending machines to micro markets, which is made economically feasible, even in small accounts, by Vagabond’s vĪv kioskless point-of-sale solution that simply uses the customer’s smartphone.

The company sources its fresh food and meals from local delis that deliver to its markets and sells them for as much as $13 a piece.

“We bring the delis to our customers, and it’s actually something they want to eat, versus the packaged triangle tuna sandwich that our industry typically decides they want,” he said. “We ask consumers what they want by engaging them with the technology we deploy, and that’s what determines what we offer, made fresh to order, and they’re willing to pay a fair price for it.”

In addition to markets, Capital Provisions is ramping up its coffee and pantry business as it gets its legs. It is focused on efficient vending operations first, markets second, and it sees coffee and pantry as areas that will add significant organic growth.

Acquisition driven

According to Lovett, 55% of workplace breakroom revenue is earned by the top 5% of operators and 45% of the breakroom food and beverage spend - or $810 million - is generated by the smallest 95% of operators, prime for acquisition.

“The U.S. vending market is huge but extremely fractured with around 8,000 operators, the vast majority of whom are small, undercapitalized, inefficient … and generating relatively meager profits because of it,” Lovett stated. “Our goal is to package up small operators, create high margins by bringing them online, establish professional business practices, and build the region’s preeminent workplace breakroom services provider. At the same time, we want to partner with sellers to provide them a fair outcome for their years of hard work and potentially bring them along for the ride if the work is a fit for their life goals.”

Full steam ahead

To better support its plans to continue to “roll up” the vending market in Southern California, Capital Provisions will soon consolidate its warehouse operations into Riverside, a centrally located oasis for distribution plants in the region. This will serve as the central location where all inventory is received, kits are prepared for the next day’s service, and then delivered overnight to regional depots.

The team behind Capital Provisions is made up of professionals who have directly helped build hundreds of small operators for a decade, and its board of directors includes individuals who have built and sold hundreds of millions of dollars’ worth of businesses inside and outside the vending industry.

On the leadership team are Chris Watson, vice president of vending operations, who sold his own vending operation, Golden State Vending, in 2016; Franco Benitez, director of route operations, who joined Capital Provisions upon the acquisition of Century Vending’s San Diego operations; and cofounder and COO Bonnie Trush, one of Lovett’s partners at Vagabond.

“We’re lucky to have experienced professionals who have done this before. All credit goes to the team, which has been relentless and swift in execution of our business plan,” he said. “Our goal is always to keep all employees we acquire, and we pay top dollar, but they need to execute to our policies. We’ve been lucky to keep some top-rate operators and employees, but it does not always work for those who are hesitant to adopt technology, and a majority of sellers are ready to retire when we buy them.”

Next in the works for Capital Provisions is executing in-progress acquisitions and partnerships with established operators in San Diego, Palm Springs, Riverside and Los Angeles this summer, which will add route density with additional accounts in existing markets. ■

About the Author

Emily Cambriello

Emily Cambriello is a business journalist who has devoted much of her career to covering the convenience services industry. She is a contributing editor to Automatic Merchandiser/VendingMarketWatch.com.