Automatic Merchandiser's State of the Office Coffee Industry report shows 2020 sales down 75%

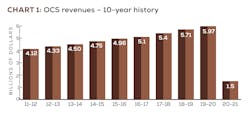

Sales in the office coffee service channel declined from $5.9 billion in 2019 to $1.5 billion, or 75%, in 2020. COVID-19’s cataclysmic impact on office worker populations effectively reversed decades of growth of a continually advancing segment of convenience services.

The performance of OCS, as well as vending, micro markets and contract foodservice, traditionally has been tied to employment, but the relationships between these service segments and their clientele changed in 2020.

No matter what you call it – virtual or online work, remote or at-home job, distributed teams, or telecommuting – a new flexible work culture is taking hold and has changed OCS, perhaps lastingly.

Looking back, OCS had enjoyed consistent annual growth between 2010 and 2019. Moderate increases in white-collar workplace populations, greater ranges of refreshment products, new brewing and pure water technologies, and improved operating efficiencies collaborated to expand the OCS market through those years.

And while the U.S. unemployment rate was historically high in April 2020 (almost 15%), a month into the officially called COVID-19 pandemic, it was the immediate swing to at-home work that dealt the severe blow to the OCS industry.

In the early stages of the pandemic, some 35% of all Americans worked from home, nearly 50 million employees, according to the U.S. Bureau of Labor Statistics. However, at the end of 2020, studies conducted by the Pew Research Center found that 71% of office workers were doing their jobs at home all or most of the time.

As a result of the vast reduction of location staff and restrictions on access to shared breakroom amenities, 90% of operators taking part in this survey reported a decrease in sales last year, with a majority reporting a loss between 50% and more than 80%.

Despite the dramatic downturn in sales, providing high-quality coffee and high-tech brewing options continued to trend in 2020, and the deployment of app-based touchless solutions became more common. The placement of bean-to-cup brewing systems, some featuring contactless interfaces, was the only equipment type to witness marginal growth last year.

FROST AND FREIGHT

Green coffee prices remained relatively stable through most of 2020, compared with the previous two years. In the first half of 2021, however, bean prices have significantly jumped each month due to frost in Brazil, freight and supply chain disruptions, and labor issues in some major coffee-producing countries, including Columbia and Vietnam. Data from the International Coffee Organization show green coffee prices up 30% in August 2021, compared with August 2020 (see chart 3A).

Most operators said they are raising prices or absorbing costs (mostly a combination of both) to offset these historically high commodity prices (see chart 3B). A small percentage of operators chose to divest their OCS businesses because of rising costs and other challenges posed by COVID’s damaging effects on business.

Almost 70% of OCS companies had to reduce their staff counts last year. Additionally, most operators represented in this survey applied and were approved for the Small Business Administration’s Paycheck Production Program (PPP) loan either in 2020 or early 2021.

In 2020, average revenue for a 6-fl.oz. cup produced by “frac packs” in a plumbed-in brewer was 11.4¢, compared with 10.6¢ the previous year. Revenue per single-cup capsule and bean-to-cup offering was 49.4¢ and 44.8¢, respectively, increasing compared with prices in previous years (see charts 4A and 4B for a five-year review). Frac packs and whole-bean varieties where the dominant coffee products sold in the OCS channel in 2020.

In OCS accounts that were open in 2020, nationally branded coffee was the top seller (27%), followed by local brands familiar to clients (26%) and private-label products (24%). The delivery format for these brands, in order of popularity: fraction pack (41.5%), whole bean (30.5%), single-cup, excluding K-Cups (14.9%) and K-Cups (13.1%). The sale of lower-cost private-label brands is expected rise in the current coffee market.

Regarding equipment, automatic pot/thermal brewers and single-cup systems continued to supplant traditional pot/thermal brewers last year (see chart 6).

Also notable last year, deliveries of janitorial supplies by OCS operators more than tripled, compared with 2019. Along the same lines, “bottle-less” water coolers enjoyed growth in 2020 as replacements to traditional 5-gal. bottle units.

Environmental impacts and social causes are part of all stages in a product’s life, particularly in the coffee industry. While corporate responsibility was overshadowed by basic survival needs in 2020, attention to ethically sourced coffee remained a priority for many operators. About 16% of survey participants said they supplied coffee with such sustainable attributes as organic, bird friendly and fair trade. More than half (53%) reported using recycled allied products in their offerings of cups, filters, containers (including pods) and utensils.

RECOVERY HORIZON

While most states are still below pre-pandemic employment levels, the U.S. economy is gradually recovering from the coronavirus; and a few states, Idaho and Utah among them, are above their February 2020 levels of non-farm payroll employment, according to recent data from the Bureau of Labor Statistics. Likewise, the office coffee service industry has already begun a recovery and is expected to restore 2020’s lost revenue in three to four years. ■

About the study

Data in Automatic Merchandiser’s State of the Office Coffee Service Industry report are collected through a 50-question survey sent to OCS and vending operators. The annual report examines responses from small, medium and large OCS providers, as well as full-line vending operations offering office refreshments. The State of the Coffee Service Industry analyzes performance in various product and equipment categories. More than 100 operators participated in the 2021 survey, which looks at the prior year. Caution should be used when comparing year-over-year numbers.

Respondent profile

Less than $500K: 53%

$500K-$1 million: 11%

$1 million-$2.5 million: 21%

$2.5 million-$5 million: 10%

$5 million-$10 million: 1%

$10 million or over: 4%

About the Author

Nick Montano

Contributing editor Nick Montano has more than two decades of experience as a business journalist and extensive experience covering news in the vending, office coffee service and micro market industry. His industry roots go way back: His first jobs were managing the stockroom of a full-line vending company and filling in for vacationing route drivers during his high school summer breaks.

To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].