2012 State of the Vending Industry Report: Vending sales reflect a slow economic recovery

Editor's Note: This is an expanded version of the 2012 State of the Vending Industry Report that appeared in the June/July Issue

The road to recovery has been slow in the recession, for both automatic merchandising and the multiple industries it serves.

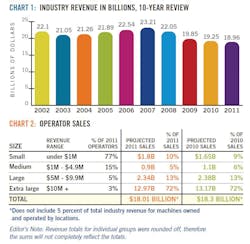

Fiscal 2011 saw trends from the previous year continue, as the vending industry slowly recovers from the massive fallout of the Great Recession. In 2011, industry sales declined for the fourth consecutive year, although at a progressively slower rate. The 1.5 percentage point sales decline in 2011 was half the rate posted in 2010, indicating vending operators made progress in stemming the downward trend.

According to the Automatic Merchandiser State of the Vending Industry Report, aggregate vending sales fell to $18.96 billion, taking the volume to a level comparable to the early 1990s.

Aggregate sales declined while operators continued to raise prices for the second straight year, though prices rose less in 2011 than 2010. Falling sales in conjunction with higher prices indicated unit sales fell more than dollar sales, another trend from 2010 that carried through 2011. Operators raised prices both years in response to higher product and operating costs.

While the last two years were not growth years, the decline was less severe than the previous two years, which delivered a 15-point aggregate revenue drop.

The vending industry’s slower rate of decline in the last two years reflected a softening of the recession in 2010 and 2011. The nation’s unemployment rate fell from a high of 10 percent in the first quarter of 2009 to a low of 8.5 percent in December 2011.

Vending sales once again trailed overall foodservice sales, a trend that has been constant during the recession. Foodservice sales posted 2.5 percent growth in 2011, according to Technomic, a foodservice research firm.

The State of the Vending Industry Report is based on returned email surveys sent to more than 9,000 emails identified as vending operators in the Automatic Merchandiser/VendingMarketWatch database.

Consolidation continues

Operator consolidation continued in 2011, a trend that began prior to 2008. Medium size companies, defined as those with $1 million to $4.9 million in annual sales, experienced the most fallout in 2011, indicated in chart 2. Medium-size operators do not enjoy the economies of scale of large and extra large operators, nor do they benefit from low overhead like companies with less than $1million in sales.

The report found that operators with less than $1 million sales continued to gain market share in 2011, indicated in chart 2. While aggregate industry revenue contracted, newcomers continued to enter the industry.

One bright spot in 2011 was a slight gain in manufacturing customers, indicated in chart 3. Manufacturers have always been the most profitable vending accounts. Since March 2010, U.S. manufacturers added 500,000 employees to payrolls, accounting for 13 percent of all jobs created through early 2012, according to The Wall Street Journal. However, the manufacturing sector still employed 1.8 million fewer workers at the end of 2011 than it did in January 2008.

The production gain helped the manufacturing segment of the vending customer base grow in 2011, when the segment once again reigned as the top customer category for vending. The manufacturing segment, which has long been the vending industry’s largest single customer base, has lost market share to other customer segments over the last two decades.

Automotive production enjoyed its second consecutive growth year in 2011 following several years of decline. North American automakers increased production between six and seven percentage points in 2011, following a 2.9-point gain in 2010, according to The Detroit-based Automotive News Center.

While the manufacturing sector recovered somewhat in 2010 and 2011, vending operators were quick to point out that the workers in these locations were not as willing to spend money as they were prior to 2008. Like workers in other locations, manufacturing employees were less confident about their long-term employment security. In many cases, factories that recalled workers did so at lower wages than in years past.

Profit protection efforts continue

With sales falling and cost pressures rising, vending operators continued to enact profit saving measures in 2011, although the survey indicated these measures were less dramatic than in the previous two years.

Slightly more operators added staff in 2011 than in the prior two years, while fewer reduced staff, indicated in chart 4a. Fiscal 2011 saw the most stability in staffing in the last 4-year period.

Fiscal 2011 also saw fewer operators opt to simply absorb higher costs, although this remained the second most frequent response to higher costs after raising prices, indicated in chart 6.

The need to absorb higher costs was attributed to the limited options operators had to offset rising costs. In 2011, operators reported higher costs for health insurance, wages, benefits, and products.

The National Restaurant Association (NRA) reported that wholesale food prices jumped 8 percent in 2011, the biggest 1-year gain in more than three decades. The aggregate gain in the last five years was more than 26 percent.

The gain in food prices in 2011 was the second consecutive increase following a 3.8 point decrease in 2009, the NRA reported.

Slightly more vending operators rearranged routes in 2011 rather than reduce service frequency, indicated in chart 6. This marked a shift from the prior three years when more operators reduced service frequency.

Elimination of unprofitable accounts remains at essentially the same level, although it has progressively tapered off in the 4-year period.

Rearranging job roles in order to improve efficiency slipped to lowest level in four years.

Fiscal 2011 witnessed more expansion into new services than any in last four years, indicated in chart 9a. Much of the expansion was in micro markets, although some also occurred in wholesale delivery; delivering product to non-vending accounts.

Investment in technology gains

As operators felt their businesses stabilizing more since 2008, many invested in new technology, indicated in chart 10a. More operators recognized that new tools such as DEX-based management, remote machine monitoring and cashless transaction capability can improve sales and profitability. However, because the technologies require a lot of training and carry a long-term payoff, the rate of operator investment has been slow. Technology providers interviewed by Automatic Merchandiser concurred with this assessment.

Nevertheless, more operators invested in new technology in 2011 than any time prior to the start of the Great Recession. This demonstrates both an evolving understanding of the need to adopt new technology and of the commitment that a cadre of technology providers have made to the industry.

Operators also noted that introducing a new technology, be it a cashless reader or a bill recycler, makes it easier to justify price increases to customers.

Technology providers continued to introduce more products in 2011.

Bill recyclers increased in 2011, indicated in chart 10a. This was driven largely by price points exceeding one dollar. Bill recyclers serve a similar purpose as dollar coins. However, many operators have difficulty sourcing dollar coins.

Operator offered mixed views about the success of bill recyclers.

Some said bill recyclers gave an immediate financial benefit since it allowed them to pull free-standing bill changers that hold large amounts of cash.

Many operators, however, said they viewed the recyclers as more of a customer convenience rather than a sales builder.

Some said bill recyclers increased service calls.

Some also said recyclers are not necessary if they use cashless readers. Others, however, said recyclers complement cashless readers in allowing the machine more versatile payment options.

The percentage of machines equipped with cashless readers also increased in 2011, indicated in chart 10a. The percentage, while small, has increased consistently over the past three years.

The increase is due partly to rising retail prices (which support cashless acceptance), competitive pressure, and a stronger understanding by operators of the benefits that cashless provides.

This year, the report separated “open” cashless installations from “closed” installations, indicated in chart 10b. The “closed” systems, only accept prepaid cards and do not accept credit and debit cards.

The report found that “closed’ cashless systems, which have existed for many years and are mainly found in prisons and schools, declined while “open” cashless systems increased.

Cashless installations increased in 2011 despite a setback posed by the Durbin Amendment to the Dodd-Frank financial overhaul. Financial institutions raised rates on small ticket debit card transactions in October 2011 to make up for rates limiting what they could charge for larger transactions.

Some debit card processors temporarily stopped accepting debit cards in vending machines. In some cases, vending operators, worried about excessive transactions costs, notified customers they were not accepting debit cards.

Eventually, card processors won an agreement from Visa, the most popular debit card used in vending, to limit its interchange fee for small ticket transactions.

The issue created a public relations problem for some vending operators, some of which put their cashless programs on hold.

The setback was temporary, however, as operators recognized consumers were moving to cashless buying. Operators also noticed that cashless acceptance reduced customer price resistance on higher ticket items, and it also reduced costs associated with handling cash.

Some operators addressed the debit card fee by placing notices on their machines saying that only credit, not debit, cards were accepted.

Operators noticed that in many locations, it took time – sometimes several months – before customers began using card readers.

The report indicated more investment in remote machine monitoring (RMM) hardware and software. However, this investment does not reflect the number of machines actually reporting data via telemetry.

The survey asked operators if they added RMM hardware and/or software in 2011. Automatic Merchandiser discovered that respondents answered “yes” if they invested in hardware and/or software that will eventually give them RMM capability.

In the meantime, many operators believe they can utilize machine level electronic data to pre-kit their routes. Operators can gain efficiencies from pre-kitting without RMM. However, pre-kitting in conjunction with remote machine monitoring (RMM), once this occurs, can deliver even greater efficiencies; it can allow operators to schedule deliveries on an as-needed basis.

2011: Micro markets emerge

Perhaps the most dramatic development of all in 2011 was the surge of self checkout micro markets. A handful of vending operators have operated micro markets since 2006. Since then, more systems have been introduced and tested. In 2011, more companies offered micro markets.

Automatic Merchandiser estimated slightly less than 1,000 micro markets were in operation by the end of 2011. While the number was not significant enough to impact aggregate industry sales, the growth of these systems was undeniable.

Micro markets provide a much larger product variety than vending machines. Most operators using micro markets estimated the markets at least doubled the sales of vending banks for the same upfront cost.

Operators also noted there is less price sensitivity in micro markets than vending machines.

In addition, because the systems have cashless readers, they are able to offer more flexible pricing than vending machines, which require nickel increments.

Micro markets also carry a larger percentage of food than vending banks. Operators estimated food accounted for between 30 and 40 percent of all products sold in micro markets. Hence, the micro markets allowed operators to reclaim a big product segment they lost in the last decade – food. Operators lost much of their food business over the years due to account downsizing and competition from other retail channels.

Because micro markets were so new, operators using them experienced a learning curve. Operators needed to educate customers in using the micro markets.

Operators also encountered reluctance on the part of customers who fear micro markets will encourage theft.

NAMA steps forward to promote technology

The innovation taking place in vending, coupled with a consumer more accepting of automation in general and a growing inclination to use cashless payment, prompted the National Automatic Merchandising Association (NAMA) to conduct an extensive consumer research study in 2011. The results of this study formed the basis of an industry growth strategy that included a social media marketing campaign to promote the vending industry.

The industry growth strategy also included a mobile marketing tour to seven markets with high populations of younger consumers, known as “Gen Y.” These “Gratitude Tour” events featured high tech vending machines and free products. The events grabbed a lot of media attention and introduced thousands of people to high tech vending machines.

The industry growth strategy also included a Facebook contest whereby consumers could “like” vending machines and compete for prizes. Thousands of consumers participated in this contest nationwide.

Regulatory issues remain

The most significant regulatory issue in 2011 was the federal calorie disclosure law under the federal health care reform law signed in 2010. The law requires a vending operator with 20 or more machines to post calorie counts at the point of sale. NAMA submitted suggestions to the U.S. Food and Drug Administration to make the rules manageable for vending operators.

The FDA missed its 2011 deadline for announcing final regulations for vending machines. The rules will not become mandatory until at least one year after final regulations.

As of spring 2012, it was not known when or if the FDA will release final rules. Some observers suspect the status of the health care reform law is uncertain due to a legal challenge.

Calorie disclosure nonetheless encouraged technology providers to develop touchscreens and calorie databases for vending machines.

The Obama administration continued to encourage health and nutrition in schools. In response, the food and beverage industry introduced front of pack nutrition labeling to make it easier for consumers to read nutrition information on product labels.

Following is a summary of the main vend product segments.

Cold beverages falter

In 2011, cold beverages, the largest product segment in vending, failed to sustain the comeback posted in 2010. This reflected the performance of cold beverages in all retail segments, according to the New York City-based Beverage Marketing Corp., which tracks beverage trends.

In 2010, the State of the Vending Industry Report noted cold drinks posted a 1.58-point gain, reversing declines from the previous two years. The gain in 2010 was driven by a mild resurgence cold beverages experienced in all retail outlets.

The Beverage Marketing Corp. reported that liquid beverage refreshment sales slowed in 2011 following the mild surge in 2010. BMC reported beverage sales increased by 0.9 points in 2011, compared to a 1.2-point growth in 2010. BMC attributed the slowdown to higher prices in 2011 as consumers resisted price increases.

One factor hurting vending in particular was a decline in machine placements in 2011, indicated in chart 13a. This reversed the uptick in beverage machine placements reported in 2010, reverting back to the previous 5-year declining trend.

The majority of machines removed in 2011 were can machines. The decline in these machines can be tied to a growth in glassfront machines, which carry both cans and bottles. The decline in can machines did not undermine cans’ market share of vending sales in 2011. Cans still accounted for 29 percent of vend beverage sales. Given the decline in can machines, sustained market share for this segment indicates can sales increased at the expense of bottles.

Chart 13c indicates operators raised can prices more than bottle prices in 2011. Operators noted they had more leverage in pricing cans since there were fewer retail outlets where consumers can compare vend can prices to prices in other retail outlets, as opposed to bottles, which are sold in most retail outlets.

Operators raised both can and bottle prices every year for the past four years, indicated in chart 13c. In 2011, the increase was greater for cans than for bottles, a reversal from 2010 when bottle prices increased more than can prices.

Vending operators attributed the growth in cans at the expense of bottles to consumer preference for lower prices during the recession. This finding is consistent with BMC’s contention that consumers are gravitating to lower price offerings.

Vending operators also noted that container deposit fees did not apply to cans as much as bottles.

Glassfront beverage machines continued to expand at the expense of closed front machines in 2011, indicated in chart 13a. Glassfront machines allow operators to offer a greater product variety.

But while glassfront machines gained placements, they remain a minority of cold beverage machines. Hence, vending operators have not been positioned to take advantage of the disproportionate growth in non-carbonated beverages that has characterized the liquid beverage refreshment business in recent years.

Premium beverages such as ready-to-drink (RTD) tea and coffee, sports beverages and energy drinks advanced particularly forcefully during 2011, BMC reported, while carbonated soft drinks and fruit beverages stagnated.

Energy drinks, a small market segment, grew faster than all other segments with a 14.4 percentage point volume increase in 2011, BMC reported.

RTD coffee, also a small segment, charted the second fastest surge at retail, growing by 9.4 percent growth.

Bottled water continued the recovery it posted with a 3.5-point gain in 2010 following two years of decline, posting a 4.1-point gain in 2011.

Carbonated soft drinks, still by far the biggest liquid refreshment beverage category, continued to lose both volume and market share, BMC reported.

Candy, snacks and confections struggle

Candy, snacks and confections, the largest vend product segment after cold beverages, performed in accordance with overall vending sales in 2011, posting a 1.5-point decline. As with cold beverages, the candy, snack and confection category lost sales despite retail price increases. Hence, turns fell more than dollar volume did.

Fiscal 2011 marked the third straight year vending operators raised candy, snack and confection prices, but the increases for the top selling products were progressively less each year, indicated in chart 14d. This demonstrates operators found it increasingly difficult to raise prices during the recession.

Operators interviewed noted that winning permission to raise prices from location managers was easier than ever in 2011, due to higher prices at retail. Getting the end users to accept the higher prices, however, has been a struggle.

Data provided by Management Science Associates (MSA), which tracks line item dollar and unit sales in this segment, indicated unit sales posted larger declines than dollar sales for the second straight year in 2011. This explains why the segment continued to lose volume despite price increases and no change in machine placements.

Candy once again lost market share to snacks in 2011, indicated in chart 14b, continuing a trend from the previous five years. However, in each of the last three years, the loss was less on a percentage basis. This indicates the decline in candy sales is bottoming out.

Operators began reducing candy at the expense of snacks several years ago when snack manufacturers increased snack product variety. The trend accelerated in 2006 and 2007 when candy manufacturers increased prices.

Some operators noted that the reduction in candy facings hurt total candy/snack sales since candy items historically sell faster than snacks.

Larger size candy, intended to rejuvenate candy sales, failed.

In April of 2012, Automatic Merchandiser published an article documenting the decline in both large size candy and large size snacks in vending. In comparing sales of these items for 2009, 2010 and 2011, MSA found operators gradually removed more large size items every year, despite the fact that price points increased each year.

Large size candy items never gained the volume that large size snacks achieved. In 2011, MSA found 74 percent of machines carried large size snacks while only 14 percent carried large size candy.

A key reason was pricing. Large size candy carried price points in excess of $1.00, which most operators viewed as the ceiling for what consumers would pay.

Instead of carrying large size candy, operators raised prices of regular size candy, mostly staying at or below the dollar price point.

Chocolate candy, which comprises the majority of candy sales, slightly increased its share of the business in 2011 at the expense of all other types of candy, indicated in chart 14b.

In the snack segment, food snacks and nuts and seeds increased market share the most in 2011.

Food snacks sales and turns improved for the second straight year; this year the turns gained even more.

Nuts and seeds improved both sales and turns following declines in 2010.

Baked goods, crackers and nutrition snacks also grew market share in 2011, although they lost turns.

Nutrition snack turns and sales took a hit in 2011 after growing in both areas in 2010. Possibly operators grew less interested in offering items that don’t turn well, even as customers kept asking for them.

Hot drink vending struggles; opportunity calls

Hot beverage vending remains unable to capitalize on a growing U.S. coffee market. The survey reported the number of machines declined in 2011, continuing a trend that precedes the recession.

Fewer hot drink machines, coupled with stagnant coffee prices indicated in chart 15d, once again undermined hot beverage sales in 2011. Yet the 1.3-point decline was less severe than for vending overall, indicating progress in this long suffering segment.

Hot beverage vending has some unique challenges.

One challenge is the unfavorable economics of operating a hot beverage machine.

The vending industry has found itself in a “chicken and egg” scenario with hot beverage vending. Equipment manufacturers have not innovated in this segment mainly on account of perceived weak operator demand. Operators, in turn, have not had machines to provide higher quality coffee that could fetch higher price points.

One exception was the Seattle’s Best Coffee machine, introduced in 2010 by Starbucks and Crane Merchandising Systems.

While many operators reported being able to win higher price points with the Seattle’s Best Coffee machine, machine purchases were stymied due to operator unwillingness to invest in expensive equipment during a recession. The opportunity was limited to accounts large enough to support the investment.

Many vending operators compensated for the decline in hot beverage vending in recent years by expanding into OCS, which was the vending industry’s only growth area in 2011. By getting locations to pay for employee coffee, operators created a new revenue stream with OCS. OCS sales surpassed hot beverage vending sales beginning in 2007 as a percent of total vending industry sales.

In 2010, OCS posted the largest 1-year sales gain among all product segments measured in the State of the Vending Industry Report. In 2011, OCS was automatic merchandising’s only growth segment.

Consumer research indicates vending operators have an opportunity to improve hot beverage sales.

In 2011, NAMA announced the results of a consumer survey that pointed to a big opportunity for both OCS and hot beverage vending. The consumer survey, conducted in 2010, found consumers overall hold coffee at work in high regard.

The NAMA survey found that while only 20 percent of consumers said their coffee comes from a free coffee maker or vending machine at work, 60 percent of all employed coffee drinkers considered free coffee as an important employee benefit. Generation Y consumers (age 18 to 27) were the most likely to try a coffee vending machine; 60 percent said they would buy less from a specialty coffee shop if vended coffee tasted better.

Coffee sales overall have not only sustained, but grew during the recession. The National Coffee Association reported that following a decline in 2010, coffee consumption increased among consumers 18 to 39 years of age in 2011.

Rising consumer appreciation of high quality coffee has boosted the placement of single-cup machines in offices and the sale of homeowner single-cup systems.

Food struggling, but positive signs emerge

Vend food sales in 2011 continued the declining trend that precedes the recession, but as with other segments, the decline decelerated in 2011. Vend food, like hot beverage vending, has been disproportionately hurt by the loss of blue collar manufacturing work sites.

Operators once again raised food prices in 2011, driven by rising wholesale food costs. Vend food price increases did not keep pace with wholesale food prices in 2011, which according to the National Restaurant Association, jumped 8 percent in 2011, the biggest 1-year gain in more than three decades.

Looking at product mix in food machines, the most notable change was the decline in non-food items sold in food machines. Most non-food items in food machines refers to beverages, such as milk, juices, ready-to-drink tea and sports drinks.

The decline in non-food offerings indicates food products sold slightly better in 2011 than in 2010, when operators increased non-food offerings. Operators typically use non-food items to reduce the amount of food waste since non-food products have longer shelf lives.

Operators also added more freshly prepared food in 2011 than frozen or shelf stable food, indicated in chart 16b. This reversed a trend from 2010, when operators used more shelf stable food and reduced the amount of both frozen and freshly prepared food.

The State of the Vending Industry Report noted a big gain in ambient machines being used to offer food in 2009, which it attributed to the removal of frozen and refrigerated machines.

Frozen food machine placements resumed their upward trend in 2010 following a 1-year decline in 2009, and this upward movement continued in 2011. Operators had consistently added more frozen food machines since their introduction in the mid 1990s.

The gain in frozen food machines in both 2010 and 2011, however, did not compensate for the decline in refrigerated machines, which has been occurring since the 1990s.

Integrated food systems, which heat and serve pre-cooked meals, suffered a hefty loss in 2010 due to the liquidation of a major operator of these systems.

Self checkout micro markets, still in their infancy, benefited food sales more than any other product segment in 2011. Where food sales accounted for 4.3 percent of total vending sales in 2011, in micro markets, food accounted for as much as 35 percent of total sales.

Micro markets, by offering so much food, make the break room more of a meal destination than a vending bank.

Milk sales fall again

Milk sales fell for the fourth consecutive year in 2011, reflecting an overall decline in milk consumption. The 14.5-point sales decline in 2011 was the steepest since the start of the recession for milk.

The decline in milk vending was driven by a loss in both dedicated milk machines and refrigerated food machines, the latter of which carried most vend milk. Refrigerated food machines and dedicated milk machines were historically placed in industrial accounts which have declined steadily in recent years.

As noted in the discussion on the food segment, vending operators used less “non-food” items in their refrigerated food machines in 2011 in an effort to improve sales of their higher priced food items. Operators traditionally use non-food items, which include milk and other beverages, to reduce food waste since the non-food items have longer shelf life.

Milk sales were also challenged by a softening of demand for milk in all retail segments. A decline began in 2010 and continued in 2011. MilkPEP, a Washington, D.C.-based organization that tracks milk sales, reported total U.S. fluid milk sales declined by 1.7 percent in 2011. The MilkPEP All Channel Tracking study confirmed that vending sales declined more than total milk sales.

A public debate among nutritionists about the health benefits of flavored milk became more vocal in 2011. Nutritionists, educators and public officials began paying more attention to the debate out of concern for rising childhood obesity. Some school districts removed flavored milk in 2011, while others chose to keep it.

The milk industry recently began positioning milk as a rehydration drink for athletes.

Ice cream sales taper off

Ice cream sales, which posted a hefty gain in 2010, tapered off in 2011, indicated in chart 18b. Some of the loss was driven by the removal of dedicated ice cream machines, indicated in chart 18e.

Retailers in all classes of trade reported higher ice cream sales in 2010 due to a hot summer.

Vended ice cream has long been volatile, due to the category’s dominance by dedicated ice cream specialists.

Most vend ice cream was sold in combination frozen food/ice cream machines, indicated in chart 18c.

The increase in frozen food machines, indicated in chart 16a, should have boosted ice cream sales in 2011 since most frozen food machines carry ice cream. However, the slight gain in frozen-prepared food sold in 2011, indicated in chart 16b, may have resulted in more food sales in frozen machines. The survey does not break out food sales from ice cream in frozen machines.

Machines that prepare ice cream from a “flash frozen” state, which were introduced in 2006, did not gain significant traction.

Consumer demand for ice cream was stable but not exceptional in 2011. Retail sales of ice cream and frozen desserts rose 2.4 percentage points in 2011, according to Packaged Facts, a research firm.

2012: Challenges remain

Vending operators were not preparing for any significant change in the business climate in 2012. The nation’s unemployment rate dipped to 8.1 percent in April, marking the best showing since the start of the recession, but the improvement was minor compared to the recession’s fallout. In addition, while the private sector added jobs in 2011, the public sector lost jobs as government at all levels faced budget shortfalls.

Vending operators agreed that uncertainty about the economy continues to dampen consumer willingness to spend money.

The National Restaurant Association expects the foodservice industry to post a 3.5 percentage point increase in 2012, translating into a 0.8-point inflation adjusted gain. This marks a slower rate of growth than 2011, which posted a 1.3-point gain.

The vending industry typically underperforms the foodservice industry during slow growth periods.

Fuel prices increased in the first quarter of 2012, but have since stabilized. The long-term outlook for fuel prices was reasonably positive, according to the Energy Information Administration (EIA). EIA expected gasoline prices to average $3.45 in 2012. That represents a slight drop from the record high of $3.53 in 2011, but still will be well above the averages of $2.35 in 2009 and $2.78 in 2010.

Health insurance costs continued to increase in 2012, a drag on the bottom lines of vending operators and all businesses.

On the upside, vending technology providers noted that vending operators continue to invest more in technology solutions that improve efficiencies and make vending machines more attractive to the younger generation.

The vending industry continues to face a challenging balancing act: making the long-term investments needed to improve sales and profits in an environment that lengthens their return on investment.

About the Author

Elliot Maras

Elliot Maras served as the editor of Automatic Merchandiser magazine from 1993 to 2012. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].