April 25, 2019 04:05 PM EDT

SEATTLE--(BUSINESS WIRE)--Starbucks Corporation (NASDAQ: SBUX) today reported financial results for its 13-week fiscal second quarter ended March 31, 2019. GAAP results in fiscal 2019 and fiscal 2018 include items which are excluded from non-GAAP results. Please refer to the reconciliation of GAAP measures to non-GAAP measures at the end of this release for more information.

“Starbucks delivered another quarter of solid operating results, demonstrating that our ‘Growth at Scale’ agenda is working,” said Kevin Johnson, president and ceo. “We are especially pleased with our comparable store sales growth in our two lead markets, the U.S. and China, where we are also continuing to drive strong new store development with industry-leading returns. With solid first-half financial results, we are on track to deliver on our full-year commitments.”

“Starbucks remains focused and disciplined in the execution of our three key strategic priorities: accelerating growth in our targeted markets of the U.S. and China, expanding the global reach of the Starbucks brand through our Global Coffee Alliance with Nestlé, and increasing shareholder returns. With our efforts to streamline the company and elevate the Starbucks brand, we are not only positioning the company to deliver more predictable and sustainable operating results but are also building Starbucks to be an enduring company that creates meaningful value for shareholders for decades to come,” concluded Johnson.

Q2 Fiscal 2019 Highlights

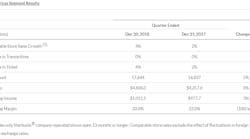

- Global comparable store sales increased 3%, driven by a 3% increase in average ticket

- Americas and U.S. comparable store sales increased 4%, driven by a 4% increase in average ticket

- China/Asia Pacific comparable store sales increased 2%, driven by a 2% increase in average ticket; China comparable store sales increased 3%, with comparable transactions down 1%

- The company opened 319 net new stores in Q2, yielding 30,184 stores at the end of the quarter, a 7% increase over the prior year. 94% of net new store openings were outside of the U.S. while 88% were licensed

- Consolidated net revenues of $6.3 billion grew 5% over the prior year

- Consolidated net revenues grew 9% over the prior year adjusted for approximately 3% of net reduction from Streamline-driven activities and a 1% headwind from unfavorable foreign currency translation

- Streamline-driven activities include the licensing of our CPG and foodservice businesses to Nestlé following the close of the deal on August 26, 2018, and the conversion of certain international retail operations from company-operated to licensed models

- GAAP operating margin, inclusive of restructuring and impairment charges, increased 80 basis points year-over-year to 13.6%, primarily due to lower restructuring and impairment charges, the beneficial impact of cost savings initiatives, sales leverage, and new revenue recognition accounting for stored value card (SVC) breakage, partially offset by Streamline-driven activities and partner (employee) and other strategic investments

- Non-GAAP operating margin of 15.8% declined 40 basis points compared to the prior year. Excluding an 80-basis point unfavorable impact from Streamline-related activities, non-GAAP operating margin expanded by approximately 40 basis points

- GAAP Earnings Per Share of $0.53, up 13% over the prior year

- Non-GAAP EPS of $0.60, up 13% over the prior year, including a $0.01 benefit from discrete income tax items

- The company returned $3.2 billion to shareholders through a combination of share repurchases and dividends

- Starbucks® Rewards loyalty program grew to 16.8 million active members in the U.S., up 13% year-over-year