Five years after the pandemic, the workplace employment patterns have largely settled into a new normal. Approximately 4 in 10 jobs allow at least some amount of remote work, according to recent data from Robert Half.1 Hybrid work is a dominant model, with more than a third of companies requiring employees to be in the office at least a few days each week.

What does all that mean for OCS operators? Hybrid work schedules result in a lower overall volume for most OCS locations. Locations are likely to serve fewer people onsite daily, with the potential for inconsistent demand by day of the week and daypart. At the same time, while volume has decreased, premiumization and higher-margin premium, single-serve and specialty options can drive revenue in locations serving fewer employees. Employers continue to offer premium coffee options such as espresso, cold brew taps and ready-to-drink (RTD) fridges to enhance the in-office experience with added perks.

Customers expect more diversity in product choices and want to be catered to, respondents noted. Demand for premium and specialty options such as cold brews and iced coffees has decreased coffee as a percentage of net sales by category. In 2024, the overall coffee category accounted for only 27% of net coffee service sales, a drop of 15% since 2022. Revenue growth is driven by bottled water (5-gallon format), which is up 4% from 2022, pantry service, which has nearly doubled, and ice machines, which grew to 11% of OCS net revenue in 2024. Cold brew formats such as on-draft kegs, single-serve packaged goods, iced coffee bean-to-cup machines and cold brew concentrate as leading OCS formats.

Let’s take a closer look at what the data tells us in our State of the Office Coffee Service Industry Report.

Adding clients and pricing hikes drive revenue growth

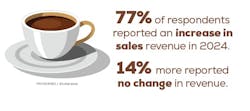

In this year’s State of the Office Coffee Service Industry Report, 77% of respondents reported an increase in sales in 2023, and 14% more reported no change in revenue. Respondents pointed to growth in clients and locations, strong business growth in their area, poor competitor service, return-to-work effects and pricing increases as key drivers of their revenue growth. Our respondents cite headwinds, including broader economic effects such as inflation, as having a negative impact on growth.

For the number of locations served in 2024, more than two-thirds of respondents (70%) reported an increase in locations, an increase over 2024 (54%) as well as an improvement on the 62% who reported an increase in locations in 2022. Respondents again pointed to strong business growth in their area and poor competitor service for their success.

The rise in locations was accompanied by a reported increase in OCS staff as well, with 48% of respondents reporting that they added staff in 2024 while 39% made no changes to head count. Those OCS operators who added staff did so strategically, with respondents reporting headcount additions for dedicated sales representatives. Operators also invested in their existing teams with additional training to better explain features and benefits to prospects and clients.

Rising costs reflect in net revenue

The costs of goods and labor were top of mind for many again in 2024. Green coffee prices have climbed steadily, although recent data from the International Coffee Organization suggests that relief is in sight.2

Inflation drove up the cost of both coffee and supplies, but price adjustments allowed operators to regain the revenue per cup they had lost in 2024 (charts 4a and b). For frac pack automatic and pour over coffee, revenue per cup, in cents per cup, rose to nearly $0.13, from $0.11 in 2023. Single-cup revenues fared better, with the average revenue per single-cup capsule of $0.49 in 2024, up from $0.38 in 2023. Average revenue per single-cup bean-to-cup products likewise increased, from $0.36 in 2023 to $0.45 in 2024.

Among the new services offered by some to add to the bottom line, micro markets (16%) were added most often. Other respondents added pantry service (13%), water services (16%), vending (10%) and even janitorial services (6%). Still, 45% did not offer any new services and looked to other strategies.

With rising costs, more than 54% of respondents reported raising some prices and absorbing some costs. Other techniques include adjusting the product mix (26%) and selling additional services (29%).

Some respondents reported scrutinizing account size, with no respondents indicating that they serviced accounts with fewer than 10 employees. The majority (61%) had typical account populations of 30 to 75 employees, with another 21% serving accounts with more than 100 employees.

Sources

1. Remote Work Statistics and Trends for 2025, https://www.roberthalf.com/us/en/insights/research/remote-work-statistics-and-trends.

2. International Coffee Organization, Coffee Market Report, July 2025. https://ico.org/specialized-reports/

About the Author

Linda Becker

Editor-in-Chief

Linda Becker is editor-in-chief of Automatic Merchandiser and VendingMarketWatch.com. She has more than 20 years of experience in B2B publishing, writing, editing and producing content for magazines, websites, webinars, podcasts, newsletters and eBooks, primarily for manufacturing and process engineering audiences. Since joining Automatic Merchandiser and VendingMarketWatch.com, Linda has developed a new appreciation for the convenience services industry and the essential role it plays. She is dedicated to serving readers by covering the latest news in the vending, office coffee service and micro market industry. She can be reached at 262-203-9924 or [email protected].