Arabica coffee prices are forecast to decline, robusta to gain 2% in 2022

Source IndexBox Inc.

In 2022, the coffee price for arabica is forecast to drop by about -2% y-o-y to $4.2 per kg, while robusta will rise by 2% y-o-y to $2 per kg, a new report published by IndexBox states.

Expected production growth in Brazil will push arabica prices down, IndexBox reported. The price increase for robusta will be prompted by heightened demand after many consumers began to seek cheap alternatives to more expensive Arabica.

The average annual price for arabica coffee rose by 36% y-o-y to $4.51 per kg in 2021, while robusta went up by 31% y-o-y to $1.98 per kg over the same period. The average monthly price in December 2021 reached $5.91 per kg for arabica and $2.48 per kg for robusta.

Brazil, the world’s largest supplier of coffee, with a 35% share of global exports, shipped 1.7 million tonnes of coffee abroad from January through September 2021, which was 5.8% higher, compared with same period of 2020. In monetary terms, Brazil’s coffee exports totaled $3.95 billion, increasing 17%, compared with the same period a year earlier. The average export price for Brazilian coffee jumped from $2.10 per kg in January to $2.77 per kg in September 2021.

Global coffee exports

In 2020, global exports of coffee in its "unroasted" (green) form declined modestly to 6.7 million tonnes, approximately reflecting the previous year. In value terms, supplies expanded to $16 billion.

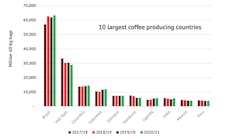

Brazil was the key exporting country that supplied 2.4 million tonnes of coffee abroad, about 35% of global volume. Viet Nam (1,208K tonnes) occupied an 18% share (based on tonnes) of total exports, which put it in second place, followed by Colombia (10%), Indonesia (5.6%) and Uganda (4.9%). Ethiopia (231K tonnes), Peru (213K tonnes), Germany (211K tonnes), India (206K tonnes), Guatemala (189K tonnes), Nicaragua (149K tonnes) and Mexico (105K tonnes) followed a long way behind the leaders.

In value terms, Brazil ($5 billion) remains the largest green coffee supplier worldwide, comprising 31% of global exports. The second position in the ranking was occupied by Colombia ($2.4B), with a 15% share of total shipments. It was followed by Viet Nam, with a 12% share.

Top largest coffee importers

In 2020, the U.S. (1.3 million tonnes) and Germany (1.1 million tonnes) represented the major importers of coffee in unroasted form across the globe, together mixing up 37% of the total volume. Italy (565K tonnes) and Japan (390K tonnes) accounted for a further 15% of global international purchases. Spain (287K tonnes), France (229K tonnes), Russia (198K tonnes), Switzerland (180K tonnes), the Netherlands (174K tonnes), South Korea (157K tonnes), the UK (156K tonnes), Belgium (146K tonnes) and Poland (128K tonnes) occupied relatively small shares of the total volume.

In value terms, the largest green coffee importing markets worldwide were the U.S. ($4.2 billion), Germany ($2.6 billion) and Italy ($1.2 billion), together accounting for 45% of global purchases. These countries were followed by Japan, Switzerland, France, Spain, the Netherlands, South Korea, the UK, Russia, Belgium and Poland, which accounted for 30%.

IndexBox is a market research firm developing an AI-driven market intelligence platform that helps business analysts find actionable insights and make data-driven decisions. The platform provides data on consumption, production, trade and prices for more than 10,000 different products across 200 countries.