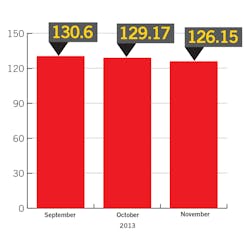

Operator confidence wanes as 2013 comes to a close. The November 2013 Operator Confidence Index (OCI) declined for the third consecutive month from 129.17 in October to 126.15, a 2.33 percent decrease over a thirty day period.

Operators witnessed an annual sales decline as consumer spending lessened. “November begins our bi-annual decline in sales which typically starts the week of Thanksgiving and returns to ‘normal’ by mid-February,” reported a Louisiana operator.

Micro market and OCS sales continued to rise while sales leveled in the vending market. Several operators indicated that OCS investments in equipment, single-cup usage and coffee quality improvement needed to increase in order to strengthen the category.

Factors such as insurance and healthcare costs, as well as pending legislative regulations, continued to act as setbacks for operator confidence.

“The biggest issue hanging over our heads is the pending regulation that is going to impact the schools. It is going to have a detrimental effect on companies that are largely represented in schools such as ours,” said the owner of a Georgia vending company. “We have a huge presence in the area high schools and sales are going to plummet.”

Operator location additionally played an unsteady role in November confidence. Operators in the Northeast witnessed business growth coming from the acquisition of other operations while a Midwest OCS operator who has contemplated micro markets said, “Micro markets will only work in large settings. A lot of the towns in the Midwest just are not big enough to have those types of businesses, and those that are big enough have cafeterias.”

Though confidence declined, one operator — who reported a higher-than-average confidence — believes his business profits come from customer and employee satisfaction. “It is so important to take the best care of your customers as possible. Keep your customers happy, and you have nowhere to go but up. The trick is to get your staff to buy into this. They are your most valuable assets,” he said. “As far as the vending industry goes, I believe the changes in our economy have benefited vending and micro markets as a whole. Customers see the value and convenience of making purchases from vending machines and micro markets versus the cost of large bills for going out to lunch,” he continued.

Methodology

The OCI is based on a monthly survey sent to the VendingMarketWatch Board of Operators and is sponsored by Mondelez International. The Operator Confidence Index is the first of its kind that tracks the level of confidence in the vending, micro market and office coffee service (OCS) industry and it is only available from VendingMarketWatch and Automatic Merchandiser.

If you are interested in joining the Board of Operators, please contact the publication assistant editor at [email protected].

Adrienne Klein | Contributing Editor

Adrienne Zimmer Klein is a freelance writer with a background in the vending, micro market and office coffee service industry. She worked as an associate editor and managing editor at Automatic Merchandiser and VendingMarketWatch.com from 2013 until 2017. She is a regular contributing writer at Automatic Merchandiser.